Best Payment Processing Companies for Ecommerce (2024)

Oct 28, 2024

Running a successful ecommerce business isn’t easy, and curveballs can appear at any moment. That's why it's important to have your systems in place whenever possible - and one of the best ways to do this?

Choose your payment processing company wisely.

Instead of dealing with all of the financial complexities and liabilities payment processing involves, why not link up with the best in the business and reap the rewards?

Here, we’ll investigate the top names in payment processing, outline what a good payment processing company can do for you, and what considerations to keep in mind when it’s checkout time.

The top 10 payment processing companies for ecommerce

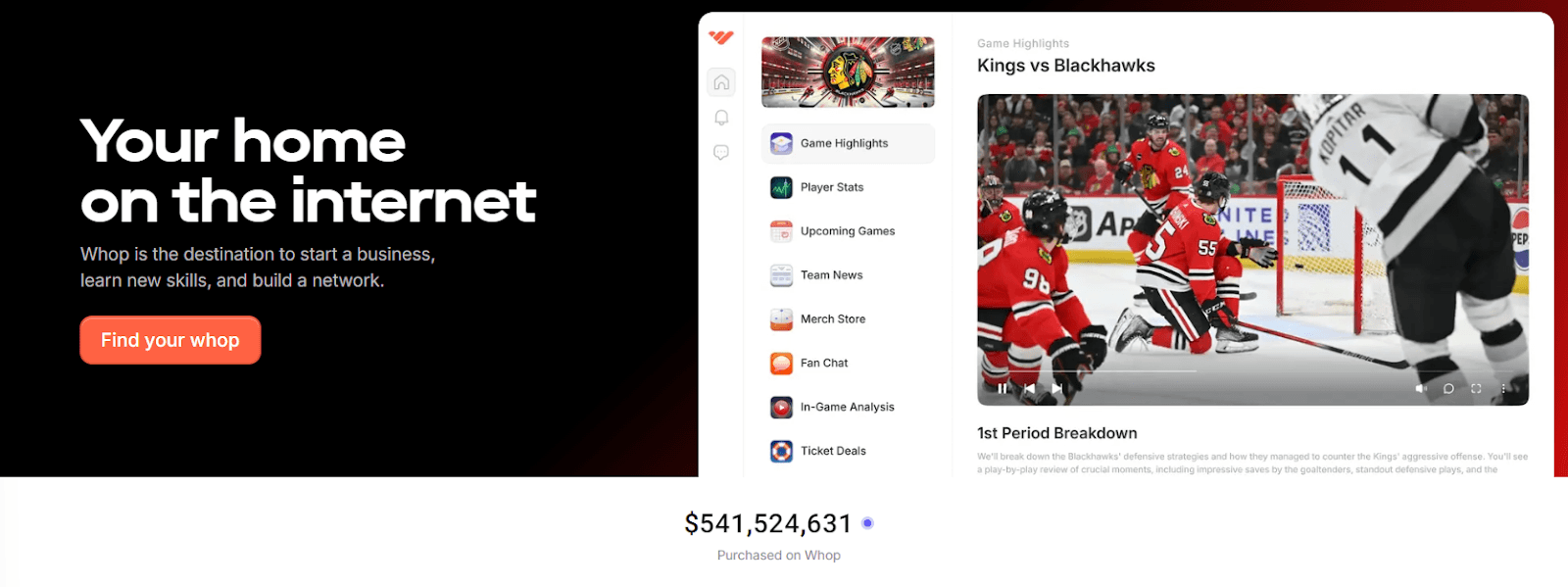

1. Whop

Whop is the hottest destination for digital ecommerce today, acting as an all-in-one platform for entrepreneurs all over the world. To date, Whop has processed over $541 million in payments across a variety of categories, and if you’re looking for an ecommerce payment processing company, Whop could well be your top pick.

Stripe is one of the most secure payment processors on the market, and while it too deserves a place on this list, Whop uses a payment gateway that’s built on top of Stripe.

This means the same safety and security with additional features, including integrations such as with Tipalti that allow Whop to process payments in more currencies than Stripe is able to.

Whop is also one of the few entrants on this list that allows your customers to pay you in crypto via an ETH gateway direct to your blockchain wallet. On top of having all of these different payment options, Whop also features best-in-class customer service with 24/7 availability and a sub-3-minute response time.

You can sell just about anything digital with Whop, and pricing’s as low as it gets with just a 3% transaction fee—perfect for smaller businesses since there’s no flat fee, and low enough not to impact your revenues as you scale.

Whop at a glance:

Price: Free with a 3% fee plus processing charges

Pros: Free-to-use and transaction fee model suit all sorts of businesses. Top customer service, and excellent security

Cons: Whop doesn’t offer physical product fulfillment, only digital

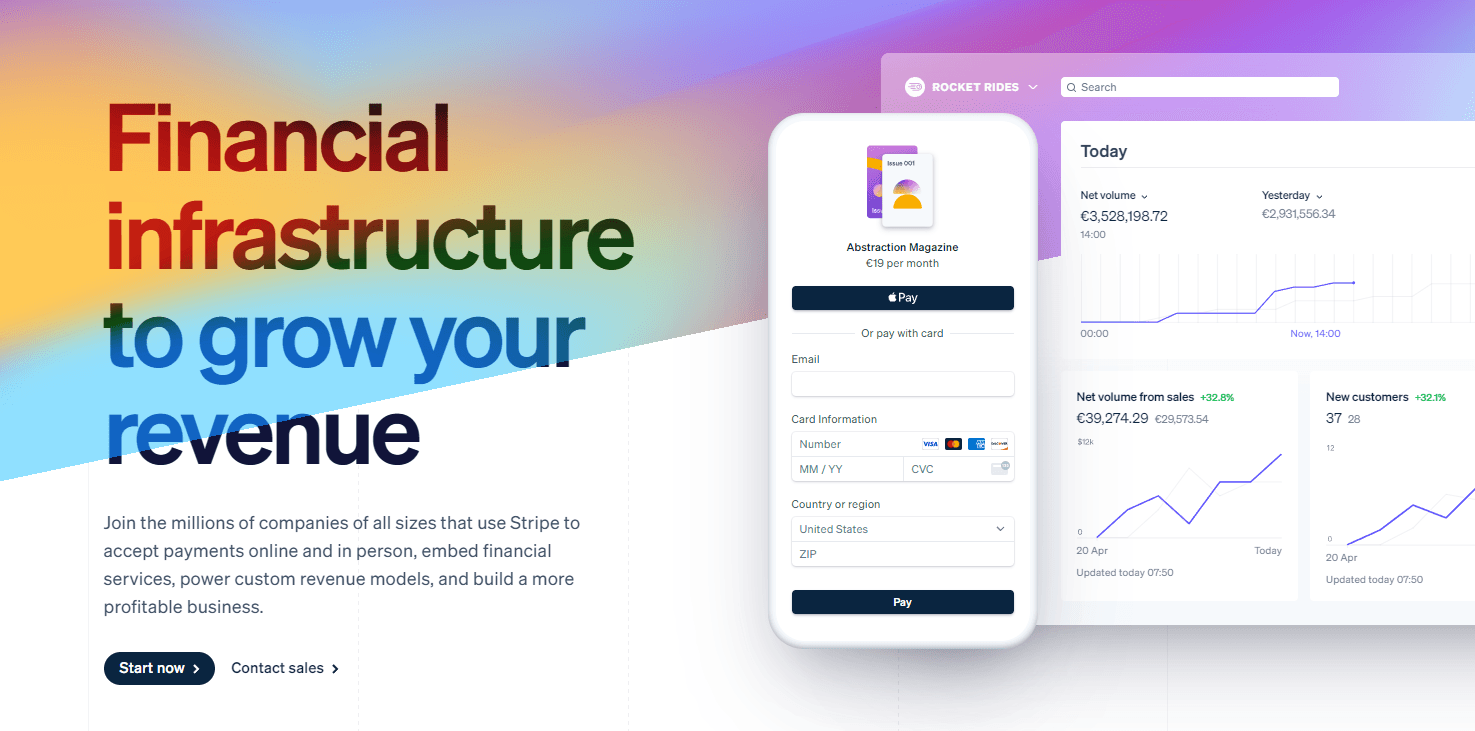

2. Stripe

Stripe is one of the top payment processing companies out there today, well-known for having the most solid payment infrastructure possible. That reputation has been well-earned across a number of years, and today Stripe offers more than just a great payment gateway.

One of the biggest advantages of Stripe is the ability to use it as a merchant account, with companies all around the world using it to accept payments both online and in person. It provides a fully integrated suite of financial and payment products so that you can use it as a one-stop shop irrespective of what sort of ecommerce business you’re running.

Stripe at a glance:

Price: 2.9% transaction fee plus flat $0.30 charge for US domestic cards

Pros: Very easy to use and integrate, and starting businesses can make full use of Stripe’s no-code products such as invoices and payment links

Cons: Doesn’t support as many currencies and payment methods as Whop

3. PayPal

PayPal has been around long enough that it’s almost strange to see a merchant who hasn’t at the very least got it integrated into their payment infrastructure. It’s a beloved option for consumers, especially given the convenience of its quick, tokenized digital wallet process, and options like PayPal Credit and delayed payment have been a boon for many.

However, PayPal doesn’t make it any higher than third on this list because it has had its share of issues. There have been instances of chargeback abuse, which have led to merchants being unfairly de-platformed. While consumer protection is definitely a good thing, leaving yourself open to abuse just wouldn’t be a very good idea even if controls have tightened in the wake of these issues.

PayPal at a glance:

Price: Most commercial transactions including PayPal Checkout and Venmo are priced at 3.49% + $0.49. Standard debit and credit card transactions cost 2.99% + $0.49

Pros: Extremely convenient and beloved by consumers for the different payment options and protections available to them

Cons: Instances of chargeback abuse and fraud as well as a record of putting disproportionate holds on merchant accounts

4. Apple Pay

If your customer research suggests that a lot of people are going to be using their Apple devices to make payments to your ecommerce site, then it’s a very good idea to consider working Apple Pay into your payments stack. It’s an extremely convenient payment processor for iPhone users, and payments can be made with a minimum of fuss.

In fact, Apple Pay has been rising the ranks in terms of popularity and became one of the top payment services in the US in 2023. Given this trend and the sheer number of Apple devices used by consumers all over the world, you might be missing a trick if you give Apple Pay a pass.

Apple Pay at a glance:

Price: Free to use although bank and credit card charges apply

Pros: Quick, convenient means of payment for consumers with Apple devices

Cons: Restricted to Apple devices, meaning that you can’t rely solely on it and definitely need to add other payment companies unless you’re running some sort of Apple-exclusive business

5. Google Pay

As you might imagine, Google Pay is a direct competitor to Apple Pay and is the corresponding option for users who prefer Chrome over iOS—with the added advantage that you can use Google Pay on an iPhone, though only for online payments.

It’s just as convenient as Apple Pay if slightly different in how it works given that transaction authentication works with either a PIN, biometrics, or a chosen passcode. Google Pay is gaining a lot of traction among ecommerce vendors and consumers alike, although it hasn’t quite reached the popularity level that Apple Pay has.

Google Pay at a glance:

Price: Free to use although bank and credit card charges apply

Pros: Can be used on all devices for online payments, and contactless on all devices except for Apple ones

Cons: Isn’t used by as many people as some of the higher-ranked entries on this list

6. Amazon Pay

With Google and Apple already on this list, it ought to be no surprise to see Amazon on it too—and this time, with their own payment processing offshoot, Amazon Pay. By using Amazon Pay, you’re essentially allowing your customers to use their Amazon accounts to check out at your store irrespective of device, and manage their payments on Amazon.com.

This can bring shopping at your ecommerce site in line with what your customers are already used to in terms of charges and interface, as well as the ability to split payments or manage recurring payments and subscriptions. Amazon Pay also gives consumers the coverage of Amazon’s A-to-Z Guarantee.

Amazon Pay at a glance:

Price: Free to use although bank and credit card charges apply

Pros: Familiar checkout experience and the ability to split payments or handle recurring charges

Cons: Limited adoption in the marketplace compared to previous entries on this list

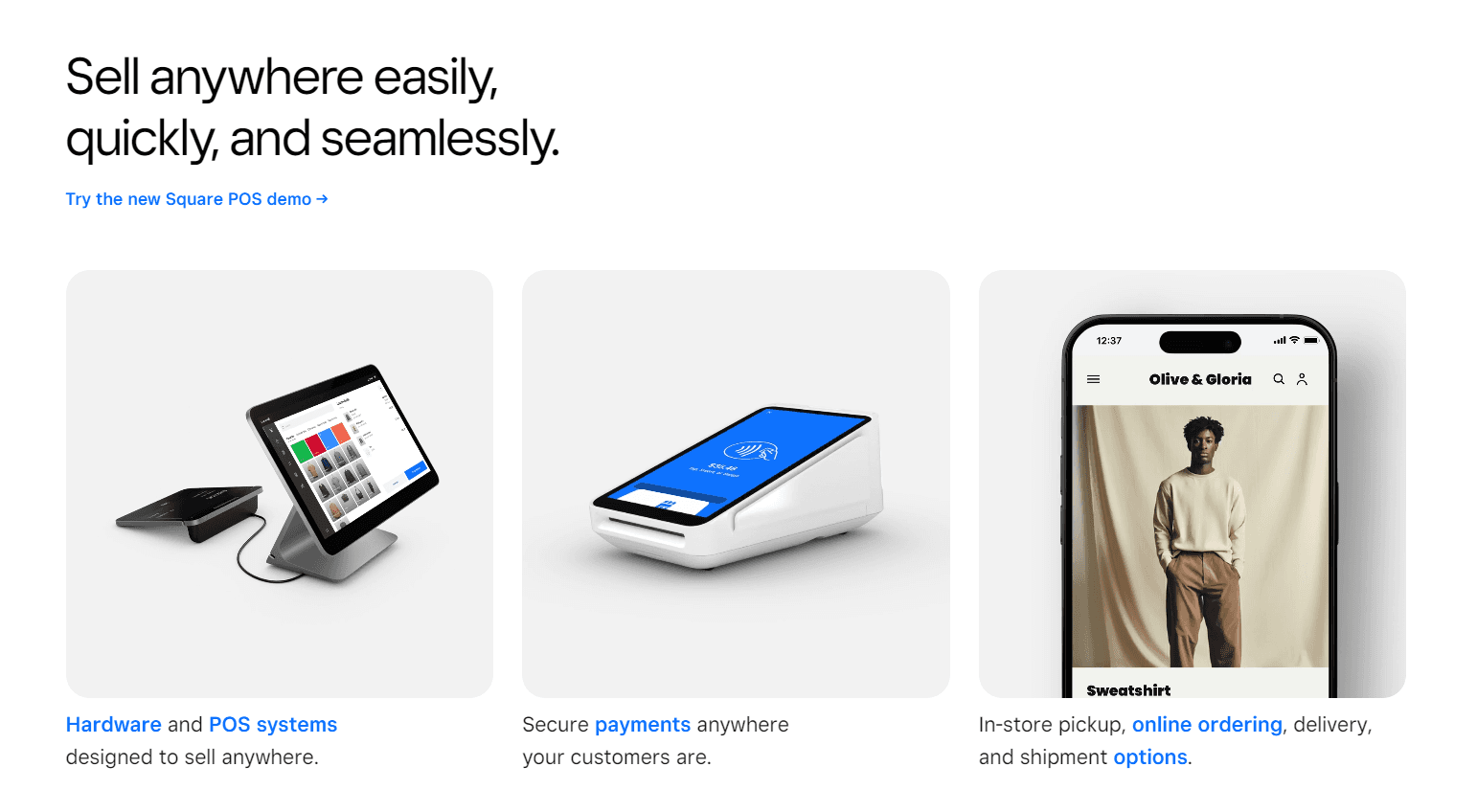

7. Square

If your ecommerce business is primarily a physical one, Square is a payment processing company well worth considering. They’re well known for their point-of-sale (POS) hardware that’s in use across a variety of industries, although they’re particularly specialized for industries such as retail, restaurants, and beauty.

You can do a lot with Square as an ecommerce partner though, via Square’s API—it’s easy to integrate with your own ecommerce software and website and use it as a virtual terminal. So, it isn’t going to be a standalone solution, but one that you can integrate along with another payment processor to use benefits like the free Square online store, buy-now-pay-later, email marketing, invoices, and much more.

Square at a glance:

Price: There’s a free plan, but you get more features if you upgrade to Plus at $29 per month

Pros: Trusted name in the world of commerce and gives you plenty of back-end and front-end advantages if you integrate it

Cons: Not a standalone ecommerce payment processor

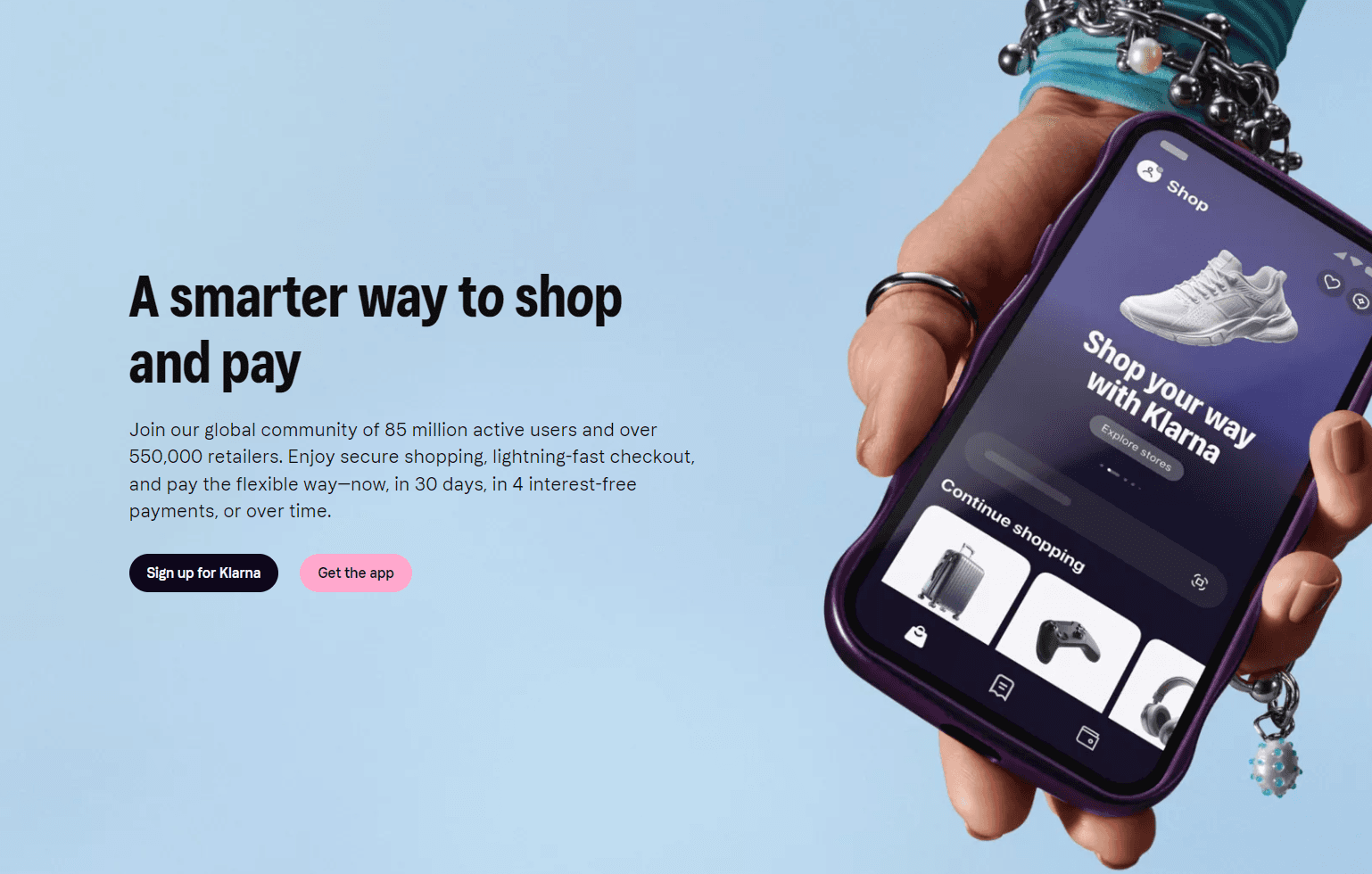

8. Klarna

Klarna is another payment processing company well-known for buy-now-pay-later, and this facility was its unique selling proposition when it launched close to two decades ago. Since then, it’s grown to work with over half a million retailers and has processed payments for over 85 million customers.

Klarna makes it extremely easy for consumers and is now even more focused than ever on its “Smoooth” identity which translates directly into the best possible consumer experience, working engagement into the previously bland, routine process of making a transaction with an online merchant.

Klarna at a glance:

Price: Variable

Pros: Extremely well-designed user interface and experience, and they give customers the ability to vary the time and terms of payment

Cons: Klarna are slightly opaque about pricing, and what the fee is will depend on the market and what sort of contract you sign

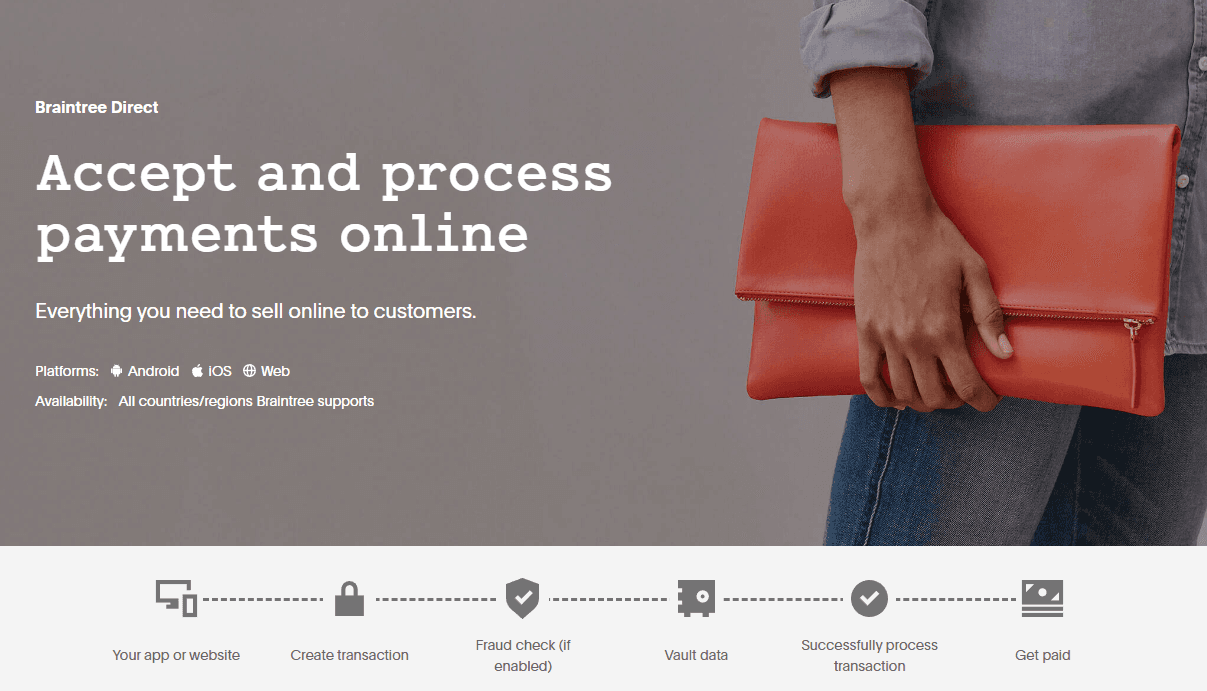

9. Braintree

Today, Braintree is part of PayPal and in fact provides PayPal with its payments infrastructure via the Braintree SDK since its acquisition back in 2013. It also powers Venmo and Apple Pay, so you know that by linking up with Braintree, you’re getting some of the best payment tech in the industry.

However, this means that Braintree suffers from some of the same pitfalls as PayPal (see above) although it does offer a lower transaction fee than its main competitor, Stripe. That said, linking up with Braintree means native integration with Venmo, Apple Pay, Google Pay, and the option to buy now and pay later, so your customers have plenty of options available to them.

Braintree at a glance:

Price: 2.59% plus $0.49 per transaction

Pros: Integration with multiple other payment methods and buy-now-pay-later

Cons: Not as recognizable as a brand, and may be pulled fully into PayPal before too long

10. Payment Depot

Payment Depot serves all sorts of businesses, big or small, and as well known as they are for their physical payment terminals, they’re also a powerhouse in the area of virtual payment terminals and ecommerce. Mobile payments are a big part of their product too, and they offer a pricing model that actually separates and itemizes the cost elements involved, letting you see exactly what you’re paying for.

Payment Depot at a glance:

Price: Variable depending on your business model, ranging from 0.2% to 1.95%

Pros: Extremely economical to use even at the higher end of their fee structure, and they are transparent about pricing revolving around payment processing

Cons: Part of the Stax family but not yet a recognizable brand name for consumers like some of the others on this list

How to choose a payment processing company for your ecommerce business

Which payment processing company you choose for your ecommerce business is ultimately up to you, but there are a number of factors worth looking at when making your final decision. They are:

🏷️Price

First and foremost, you’ll want the payment processing company you work with to be reasonable on the price front. If their revenue model either costs you an arm and a leg or digs too deeply into your profits, you’ll want to look elsewhere. As such, matching your business revenues to the revenue model of your payment processor is a good idea—a flat fee is often best for businesses that are scaling fast, while a percentage rate works nicely for smaller ecommerce businesses. The best payment processing companies are often happy to work with you to create a bespoke pricing model that best fits your needs.🔒Security

Just as importantly, you’ll want to know that the payment processing company you pick has the most up-to-date security possible in its payment infrastructure. This means full compliance but also going above and beyond with best-in-class data encryption and tokenization. As you can imagine, working with a payment processing company that doesn’t prioritize this may have dire consequences.🤝Trust

This is the other side of the security coin, but from the perspective of your customers—they can’t be expected to understand the technicalities of what safety protocols are in place with your payments, or how payment processing works. They want to be assured that they’re working with a brand that’s known for safety, so it’s worth paying attention to what consumers think of the different processing companies out there.💳Payment methods

Customers also want to be able to pay for goods or services in different ways, especially online. Some might want to use a stored payment method or digital wallet, others are happy to go with their credit or debit card. A few might even fancy paying in crypto. The best payment processing companies will cover as many different payment methods and currencies as possible.

What a good ecommerce payment processing company can do for you

Choosing the right ecommerce payment processing company isn’t easy, but the benefits can easily outweigh the effort you put in. Here’s what you’ll get out of it:

Increased conversion

This is by far one of the most important metrics in business, because it means, in the simplest possible way, that you’re going to get more sales. If the payment processing company you choose is one that customers can trust and provides access to their payment method of choice, they have no excuse to back out at the 11th hour—a smooth, safe journey through checkout inspires confidence and reinforces their conviction in the purchase.Customer satisfaction

Not only is all of the above likely to ensure that they complete the purchase, but you’ll also have a satisfied customer at the end of the day—and this means a customer who’s happy to recommend your products to others, and one who may also purchase from you again.

Process your ecommerce payments with Whop

The right payment processing company can make life a whole lot easier for you if you prioritize safety and security, and your customers are far more likely to complete their purchases if they can see that they’re in good hands—a trusted brand and a clean, glitch-free checkout experience goes a long, long way.

So, consider letting Whop process your payments! Powered by the most secure payment infrastructure courtesy of Stripe and adding even more payment methods and revenue options, including more currencies and even crypto, Whop gives you all you need on the payments front.

Plus, Whop is free, easy to use, and provides your customers with the easiest journey possible.